- Hibah Amanah

- What is Hibah Amanah?

- What is Hibah Asset?

- The fund(s) registered must be given to the donee(s) in its entirely (100%)

- To be eligible, the balance units of each unit trust fund must be 1,000 units and above throughout the period of Hibah Amanah

- The units must be wholly-owned by the donor

- Why can't ASNB adopt the nominee system as practiced by EPF or Tabung Haji?

- Why did ASNB introduce Hibah Amanah as an alternative solution for estate management?

- Can Donee(s) aged 18 years old and below receive the Hibah Asset?

- parents

- grandparents

- siblings

- registered guardian approved by ASNB

- Where can I register for Hibah Amanah?

- What needs to be done if I am interested to register for Hibah Amanah?

Complete the following documents and submit with the registration fee:

- Application form (PH1A)

- One original copy of Power of Attorney

- Is the Hibah required to agree to the hibah distribution?

- Can the unit holder invest through the EPF Members' Investment Scheme once the fund has been registered under Hibah Amanah?

- Can the unit holder take up financing or collateral for the fund registered under Hibah Amanah?

- Can a fund registered under Hibah Amanah be suspended or frozen?

- Why the minimum balance of 1,000 units required?

- Can the Donor include other assets?

- How will the Hibah asset be distributed?

- Can Hibah Amanah Donee be changed?

- What should be done in the event of death of the Donor or Donee?

- What happens to the units invested via financing upon claim by the Donee?

- Can Hibah Amanah be revoked?

- Trust Declaration

- What is Trust Declaration?

- What is a Trust Declaration asset?

- The funds registered must be given to the Donee(s) in its entirely (100%)

- To be eligible, the balance units of each unit trust fund must be 1,000 units and above

- Why can't ASNB adopt nominee system practiced by EPF or Tabung Haji?

- Why did ASNB introduce Trust Declaration as an alternative solution for estate management?

- Who is eligible to register for Trust Declaration?

- ASNB's unit holders

- Malaysian

- Age 18 and above

- Non-Muslim

- Not a bankrupt

- Sound mind

- What happens to the deed of a bankrupt Donor?

- The Trust Declaration is automatically revoked

- The unit trust funds will then be frozen

- The rights of the Donor will be determined by the Bankruptcy Law following the Insolvency Department's instructions, and so on

- What happens in the event the Donor becomes mentally disable or comatose?

- Who can be appointed as Donee?

- Donor can name any individual as a Donee limited to 10 persons per contract

- Not a bankrupt

- Donee is not a bankrupt at the time of payment of claim

- The donee is encouraged to register as a unit holder with ASNB, if eligible

- Open to Malaysian or non-Malaysian

- Sound mind

- Open to all religions

- Can a Donee under 18 years old receive the Asset?

- parents

- grandparents

- siblings

- registered guardian approved by ASNB

- Where can I register Trust Declaration?

- What needs to be done if I am interested to register for Trust Declaration?

- Application form (PH1B)

- One original copy of Power of Attorney

- Is the Donee required to agree to the trust distribution?

- Can the unit holder invest through the EPF Members' Investment Scheme once the fund has been registered under Trust Declaration?

- Can the unit holder take out a financing collateral for the fund registered under Trust Declaration?

- Can funds registered under Trust Declaration be suspended or frozen?

- Why is the minimum passbook balance of 1,000 units required?

- Can the Donor include other assets?

- How will the Trust asset be distributed?

- What should be done in the event of death of the Donor or Donee?

- What happens to the units invested via financing when the donor dies?

- Can Trust Declaration be revoked?

Hibah Amanah is the combination of "hibah" and trust concepts. It is a gift in the form of ASNB unit trust fund (Hibah Asset) from a Unit Holder (Donor) to his loved ones (Donee) during his lifetime based on the terms and conditions stated in the Hibah Deed. Transfer of the asset to the Donee(s) takes effect only after the demise of the Donor.

Hibah Asset is the ASNB unit trust fund(s) registered under Hibah Amanah by the Donor during his lifetime through the Hibah Amanah Deed:

Under the Malaysian law, the trust is classified as personal property such as company shares. Thus, the inheritance of unit trusts is subject to the laws of probate and administration where only the administrator or executor appointed by the court can claim the deceased donor's assets. On the other hand, EPF and Tabung Haji were established under their own acts that allow direct nominees.

Without an alternative solution like Hibah Amanah, the estate distribution process is complicated and time-consuming. The situation will be more complicated if there are overlapping claims and disagreement among the beneficiaries.

Through Hibah Amanah, unit holders can plan their estate distribution to their beneficiaries and this will shorten the claim process after their demise.

Hibah Amanah is based on the Sharia law. However, Faraidh law still prevails in the estate distribution for Muslims. Therefore, unit holders are advised to be fair in distributing their Hibah assets.

Yes, but a Guardian must be appointed to act on behalf of the Minor Donee aged 18 and below. The Guardian must be appointed among:

Registration can be performed at any ASNB branch.

Yes, the Ijab and Qabul are compulsory; therefore, both the Donor and Donee must agree to give and accept by signing the relevant documents.

Yes, subject to the minimum balance of 1,000 units throughout the period of Hibah Amanah.

Yes, subject to the minimum balance of 1,000 units throughout the period of Hibah Amanah.

The unit trust fund registered under Hibah Amanah can be suspended or frozen as ordered by the authority, subject to the terms and conditions of Hibah Amanah, Master Prospectus, Deed of the unit trust fund and the EPF.

One of the requirements for Hibah Amanah is to have an asset to be distributed. Therefore, the minimum balance of 1,000 units is necessary to ensure that there will be investment units available after the demise of the Donor as the Donor is allowed to do transactions during his life time.

No. Only ASNB unit trust funds can be registered under Hibah Amanah.

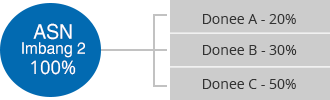

All the units in each trust fund will be distributed to the Donee(s) in its entirely (100%).

Example: The Donor has an investment in the ASN Imbang 2 fund. He must distribute 100% of the units to the listed Donee(s) as follows:

Yes. However, changes can only be made if it involves biological child and grandchildren. Otherwise, the revocation of the Hibah Amanah must be made and the Letter of Donee consent on return of asset to Donor must be submitted during application.

In the event the Donor dies first, the Hibah asset will be the absolute right of the Donee(s). On the other hand, if the Donee(s) dies first, the ownership of the Hibah asset will be returned to the Donor.

Units invested via financing is subjected to the agreement between the Donor and the Financing provider. Units still under financing will be paid to the Financing provider. Only the Donor's wholly-owned units free from encumberance will be distributed to the Donee upon claim.

Based on Sharia law, Hibah Amanah cannot be revoked, except if it involves hibah to biological child or grandchild.

Trust Declaration is the appointment of individuals as Donee(s) by a Unit Holder (Donor) during his lifetime through a Trust Deed. The distribution and claim payment will be made after the death of the Unit Holder.

Trust asset is the ASNB unit trust fund(s) by the Unit Holder during his lifetime through a Trust Deed:

Under Malaysian law, unit trust is classified as personal property such as company shares. Thus, the inheritance of unit trusts is subject to the laws of probate and administration where only the administrator or executor appointed by the court can claim the deceased Donor's assets.

On the other hand, EPF and Tabung Haji were established under their own acts that allow direct nominees.

Without an alternative solution like Trust Declaration, the estate distribution process is complicated and time-consuming. The situation will be more complex if there are overlapping claims and disagreements among the beneficiaries.

Trust Declaration can assist the unit holders plan their estate distribution to their beneficiaries.

A guardian must be appointed by the court who will be acting on behalf of the Donor based on the court's order.

Yes, but a guardian must be appointed to act on behalf of the minor Donee , age 18 and above. The appointed guardian must be among:

Registration can be performed at any ASNB branch.

Complete the following documents and submit with the registration fee:

No.

Yes, subject to the minimum balance of 1,000 units.

Yes, subject to the minimum balance of 1,000 units.

The funds registered under Trust Declaration can be suspended or frozen as ordered by the authority, subject to the terms and conditions of Trust Declaration, the Master Prospectus, the unit trust fund deeds and the EPF.

One of the requirements of Trust Declaration is to have an asset to distribute to the Donee. The Donor is allowed to perform transactions during his life time. Therefore, the minimum balance of 1,000 units is necessary to ensure that there will be units available for distribution to the Donee after the demise of the Donor.

No, he cannot. Only ASNB unit trust funds can be registered under Trust Declaration.

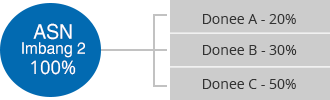

All the units in each trust fund must be distributed to the Donee(s).

Example: The Donor has an investment in the ASN Imbang 2 fund. He must distribute 100% of the units to the listed Donees as follows:

Both parties namely, the Donor and Donee(s) agree that in the event of the death of the Donor before the Donee(s), the Trust Asset will be distributed according to the division specified in the Trust Declaration Deed and it will become the absolute right of the Donee(s). On the other hand, if any one of the Donee(s) dies before the Donor, the Trust Asset will be returned to the Donor.

Units invested via financing/collateral are subjected to agreement with the Financing provider. Units under financing will be paid to the Financing provider. Only the unit wholly-owned (full ownership) by the Donor will be paid to the Donee.

Yes, Trust Declaration can be revoked.