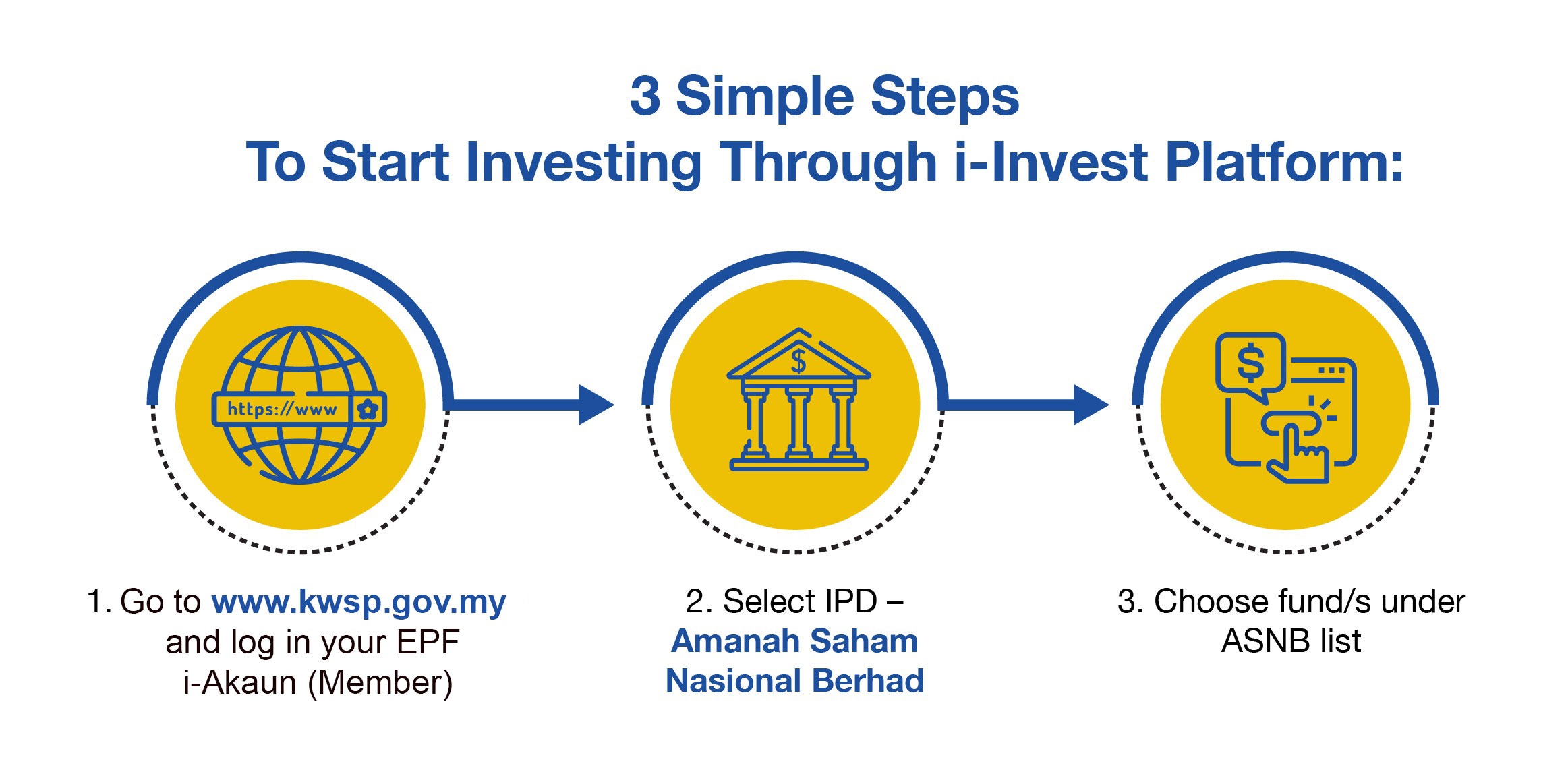

i-Invest is an online, self-service platform to facilitate investments through EPF Member Investment Scheme (MIS) in approved unit trust funds. The platform provides various comparison tools and useful information to assist members in making informed investment decisions. Members also enjoy more efficient execution of investment decisions, ease of access typically lower fees (as agents are not required), and greater functionality (overview of consolidated MIS investment holdings).

EPF Member who are eligible to use this facility are as below:-

Transactions can be done through i-Invest are :-

Yes, existing ASNB unitholders can perform investment transactions and unitholders must have a registered myASNB portal account. If you do not have a myASNB portal account, a screen will appear to assist you with the portal registration.

No. You must have a unit trust account with ASNB in order to invest your EPF money via EPF i-Akaun (Member) portal. Opening of a ASNB unit trust account can be done at any ASNB branches or Agents.

Amount of purchased units will only be shown in your myASNB portal account and EPF i-Akaun (Member) account only after money has been received by ASNB from EPF. The minimum period required for this process is as follows:-

| Balance updated in myASNB portal account | 3 working days |

| Balance updated in EPF i-Akaun (Member) | 4 working days |

For Switching OR Redemption of units, the balance will be updated as follows:-

| Balance updated in myASNB portal account | 3 hari bekerja |

| Balance updated in EPF i-Akaun (Member) | 4 working days |

You are not allowed to increase the units purchased amount at myASNB portal account. However, the system allows you to reduce the amount of unit purchased. If you wish to increase the withdrawal amount, you need to login to your EPF i-Akaun (Member) account again and choose the amount you wish to withdraw before proceeding to myASNB portal account.

| Transaction | Minimum | Maximum |

| Purchase | RM1,000 | Based on EPF investment limit |

| Switching | RM0.01 | Based on your latest unit trust fund balance |

| Redemption | RM1.00 | Based on your latest unit trust fund balance |

| Transaction | Charges |

| Purchase | Variable price funds : 0.5% Sales charge Fixed price funds : No charges |

| Switching | 0.5% sales charge will only apply for switching of units from fixed price funds to variable price funds |

| Redemption | No charges |

There is no limit to the number of transactions that can be performed through this online method for all three types of transactions.

For subscription, each transaction can be made up to maximum 8 funds.

Yes. You may purchase units from more than one funds through the i-Invest facility. The selection of funds, however, must be done at your EPF i-Akaun (Member) portal and cannot be added at your myASNB portal account.

There is a temporary suspension of switching facility for ASNB variable price funds in EPF-MIS via i-Invest from 6 May 2023 until 31 December 2023.

You may perform EPF-MIS switching transaction for ASNB variable price funds at any ASNB branches nationwide.

Yes, you may still perform subscription and redemption transactions for ASNB variable price funds in EPF-MIS via i-Invest.

No. The Switching fee for EPF-MIS remains unchanged. Details on the Switching fee for EPF-MIS via over-the counter (OTC) can be accessed via ASNB official website. Click here.