Convenience for you

Everything at your fingertips with myASNB App,

now with new feature and facelift.

Frequently Ask Questions

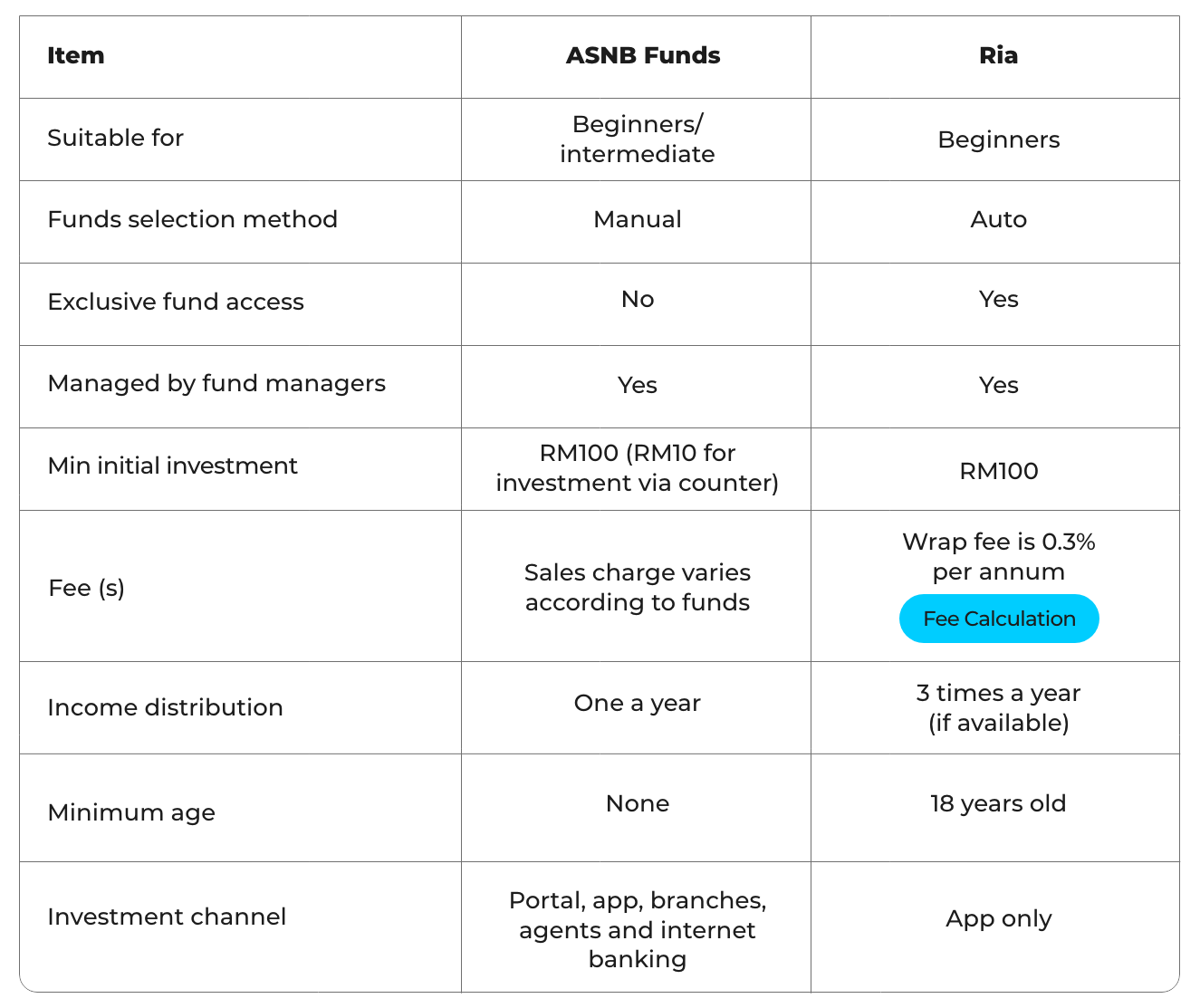

Ria is an automated investment application by ASNB licensed under the Digital Investment Management (DIM) framework by the Securities Commission Malaysia.

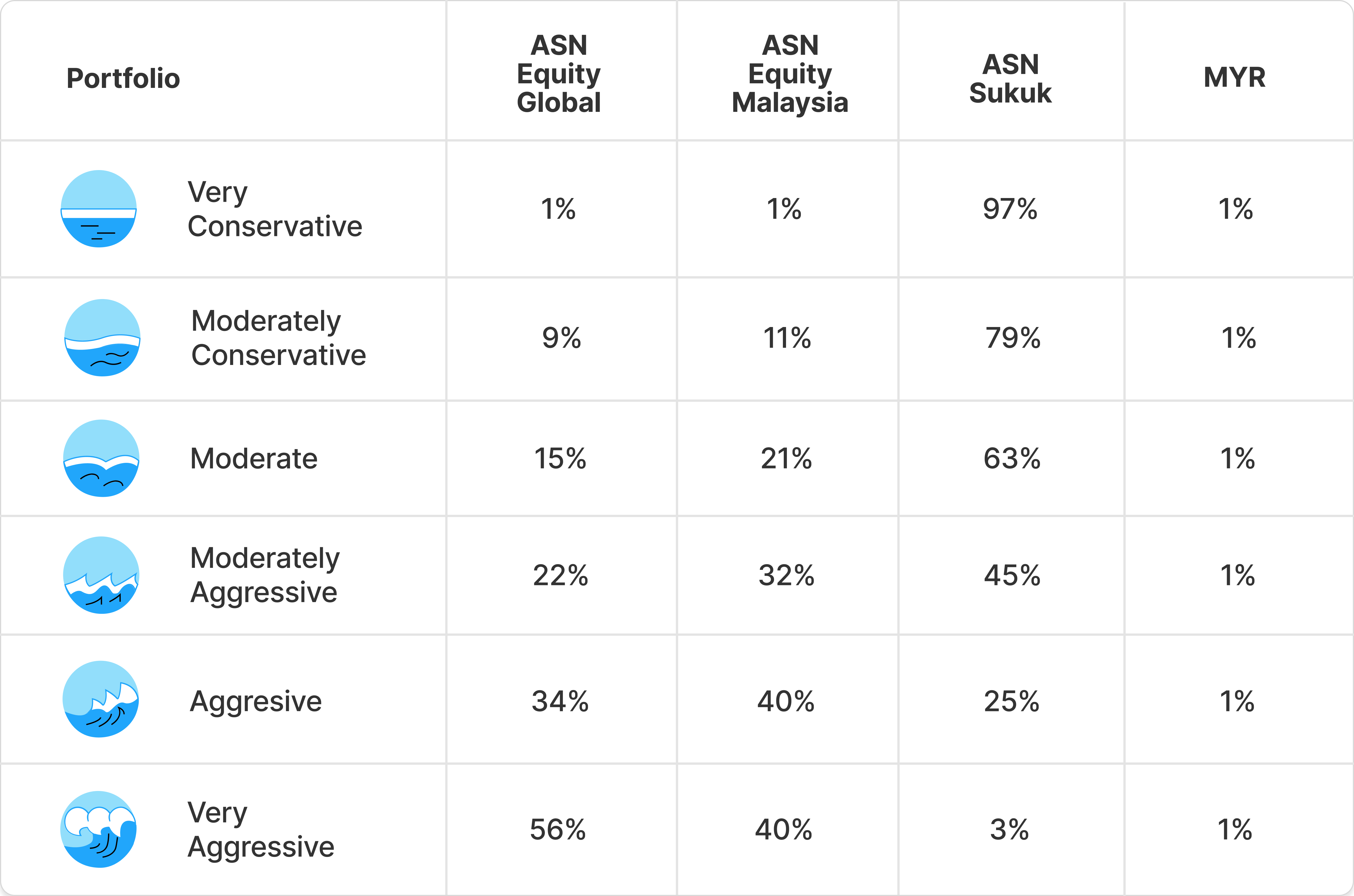

Ria works by using algorithms and Modern Portfolio Theory to create and manage personalized investment portfolios. After assessing your risk profile and investment preferences, Ria allocates your investments across a diverse selection of ASNB unit trust funds, aiming to optimize returns while minimizing risk.

Ria stands out from other robo advisors by having the backing of Amanah Saham Nasional Berhad, a trusted unit trust management company with more than 40 years of experience in the industry. Ria also differentiates itself from other robo advisors by offering portfolios comprised of ASNB unit trust funds, which focus on Malaysian and global equities as well as sukuk (Islamic bonds). Additionally, Ria provides a user-friendly platform within myASNB application, periodic rebalancing, optimization, and local expertise, all at competitive fees.

The minimum initial amount for you to invest in RIA is RM100, and the minimum subsequent investment amount is also RM100.

This low barrier of entry to invest in a diversified portfolio is intended to encourage participation in the capital markets among Malaysians to benefit from long-term investment returns.

Individuals who are citizens of Malaysia can open an account with Ria.

You will need a MyKad with a Malaysian permanent address and be at least 18 years of age. You will also need a valid email address and an active Malaysian bank account to be able to transfer funds in and out of your Ria account.

Ria, through ASNB, is regulated by the Securities Commission Malaysia under the Digital Investment Management (DIM) framework. Under the framework, ASNB is authorized to carry on the business of fund management incorporating innovative technologies into automated discretionary portfolio management services pursuant to Schedule 2 of the Capital Markets Services Act 2007.

Investing in Ria through unit trusts offered by Amanah Saham Nasional Berhad (ASNB), a unit trust management company wholly owned by PNB is classified as ‘Harus’, or permissible in accordance with Shariah requirement, by the Muzakarah of Fatwa Committee of National Council for Islamic Religious Affairs Malaysia and all State Fatwa Committees.

Ria is an investment service that is designed to help investors grow their wealth through a diversified portfolio of funds, while bank savings account is a deposit account that allows individuals to save money and earn interest/profit rate on their deposits.

Ria carries more risk, but also offers potentially higher returns, while bank savings account is a low-risk option that offers lower returns.

For your one-time deposits, your transactions will appear in your RIA account between 3-6 business days.

For Auto Labur, it may take up to 7 business days from your scheduled deduction date for the transactions status to be verified and confirmed by the custodian. Once approved by the custodian, it may take another 3-6 business days for the transactions to appear in your RIA account. The earliest that your Auto Labur may appear in your RIA account is 4 business days after your scheduled deduction date, and the latest is 13 business days after your scheduled deduction date. As Auto Labur processing involves multiple steps and parties (in consolidating intrabank and interbank transactions), periods of increased transaction volume may result in a delay for custodian to approve and for the transaction to appear in your RIA account.

Ria is accessed exclusively via the myASNB application. If the myASNB application experiences a downtime, Ria cannot be accessed by Ria investors.

ASNB will manage the downtimes for the myASNB application (e.g., scheduled maintenance) and will inform Ria investors in case there are prolonged downtimes expected.

Watch other Robo Ria tutorials to enhance your investment experience!

Watch other Robo Ria tutorials to enhance your investment experience!