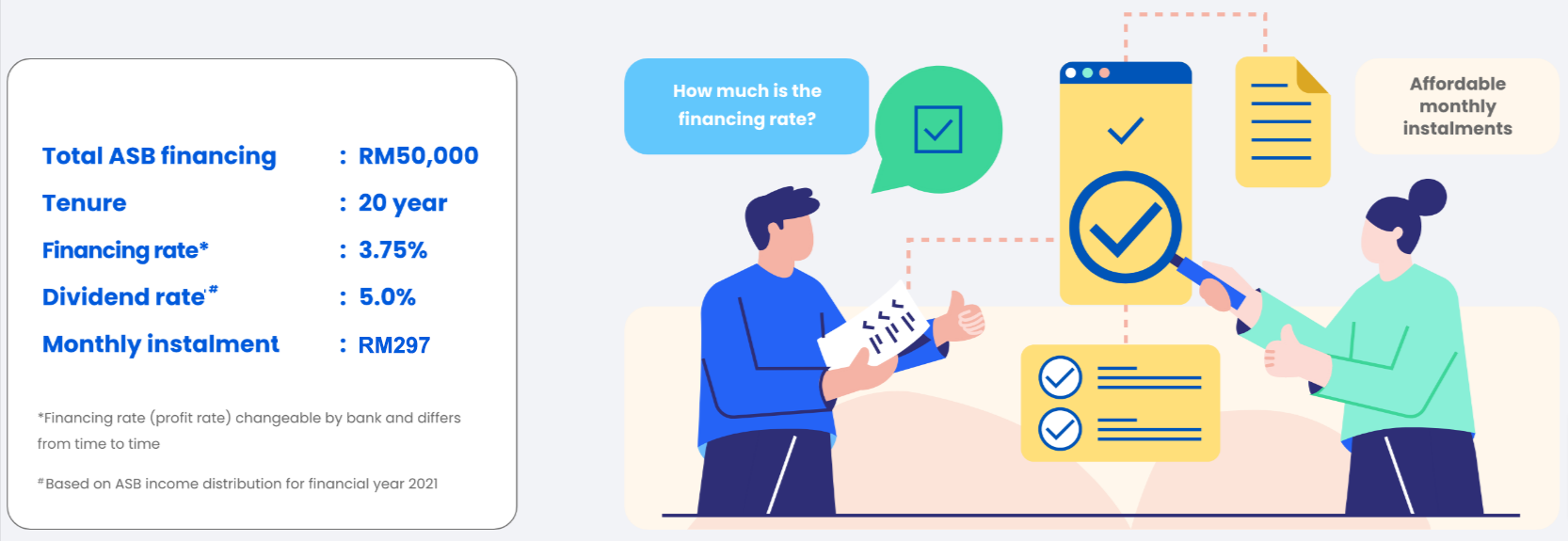

An alternative method to invest in ASB other than cash investment. This financing facility is offered by ASNB’s agent banks to investors who fulfill the criteria set by the banks.

An investment instrument that is subject to financing rates and related charges.

This financing facility is offered by ASNB’s agent banks to investors who fulfill the criteria set by the banks.

Financing with attached protection/takaful in the event of death and disability.

Does not require upfront payment or any types of collaterals.

An investment instrumen that could potentially help you achieve long-term financial objectives with forced-savings.

Please refer the latest Master Prospectus and Product Highlight Sheet for more details on ASB features which can be obtained at www.asnb.com.my, ASNB branches and agents.

Where unit trust loan financing is available, investors are advised to read and understand the contents of the unit trust loan financing risk disclosure statement before deciding to borrow to purchase units. The disclosure statement will be provided by bank for ASB financing application.

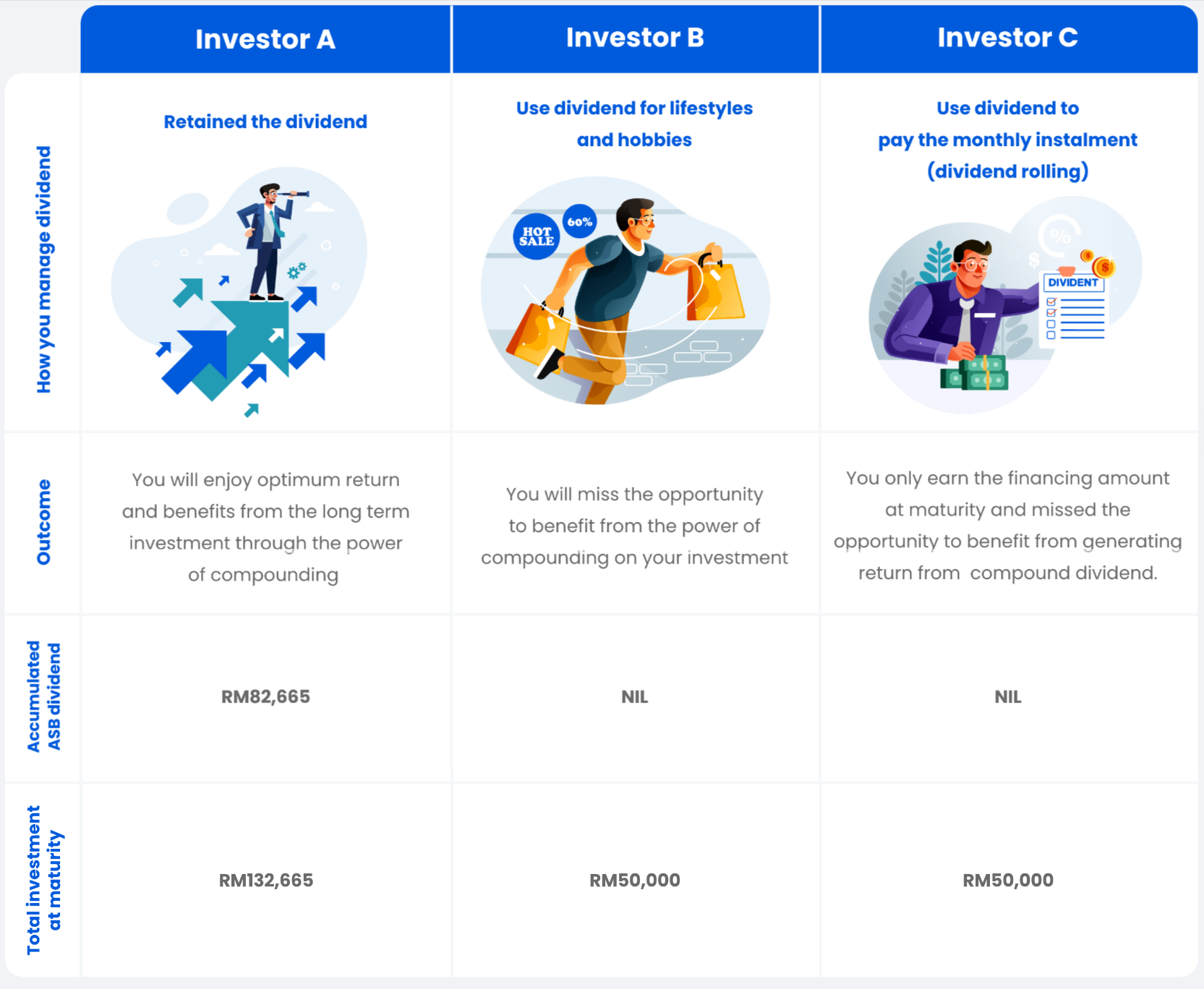

Align your investment goal and affordability. Budget the instalment amount to be within the capacity of your monthly commitment. Do not depend on yearly dividend.

Discipline yourself to pay the monthly instalment from your own cash flow and not from the annual dividend like how you pay for car/house loan repayment.

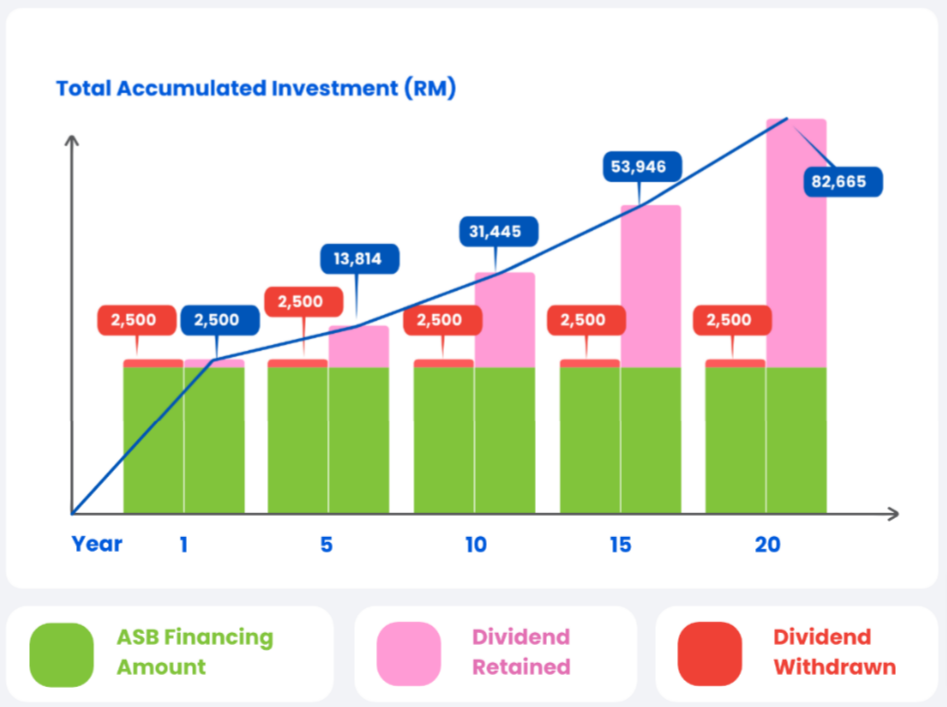

Let your investment and dividend grow over the long term by retaining your yearly dividend. The more the amount of dividend you retain (compounded), the bigger benefits you will gain as compared to use it for monthly instalment.

As ASB financing requires long term commitments, take into account your future financial commitment like buying a car/house or expanding your family expenses before deciding on ASB financing.

“Let it grow” strategy can be done by performing monthly auto-debit for payment of instalment. Once it matured, you can enjoy the fruits of your investment.

Takaful coverage that is usually offered with financing can provide peace of mind against any risks of death and disability.

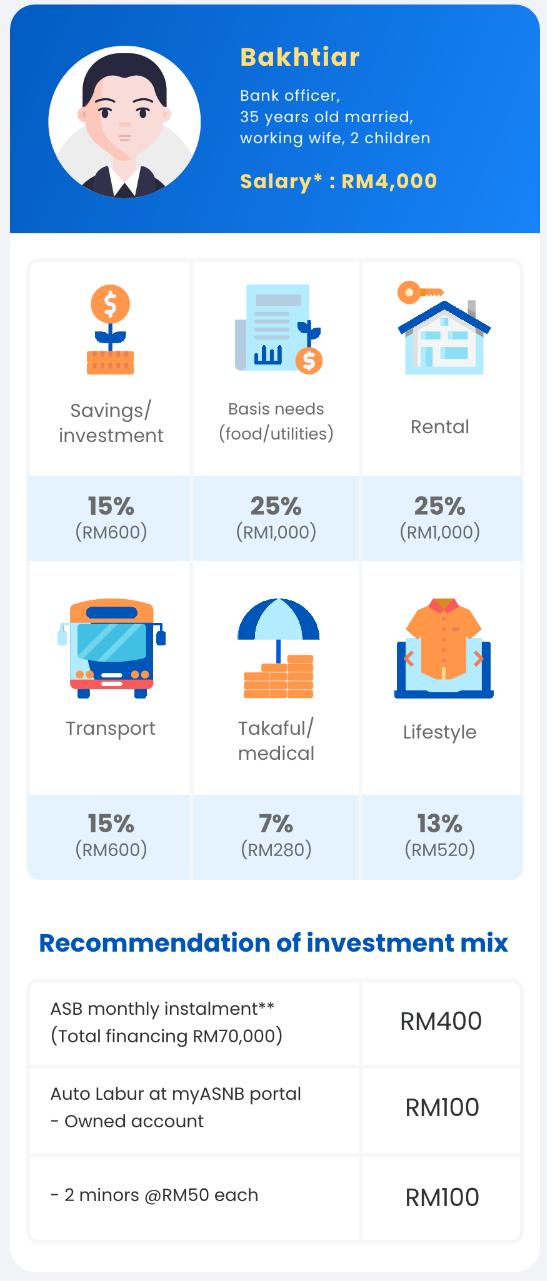

Determine the financing amount based on your income and ability to pay the monthly instalment. We provide some guidance for you.

#As illustration and recommendation for monthly budget allocation. | *Total salary has taken into account the compulsory deductions such as EPF and monthly tax deduction (PCB). | ** Total financing, rate and tenure are based on Table 1

Where unit trust loan financing is available, investors are advised to read and understand the contents of the unit trust loan financing risk disclosure statement before deciding to borrow to purchase units. The disclosure statement will be provided by bank for ASB financing application.

Please refer the latest Master Prospectus and Product Highlight Sheet for more details on ASB features which can be obtained at www.asnb.com.my, ASNB branches and agents.

Where unit trust loan financing is available, investors are advised to read and understand the contents of the unit trust loan financing risk disclosure statement before deciding to borrow to purchase units. The disclosure statement will be provided by bank for ASB financing application.

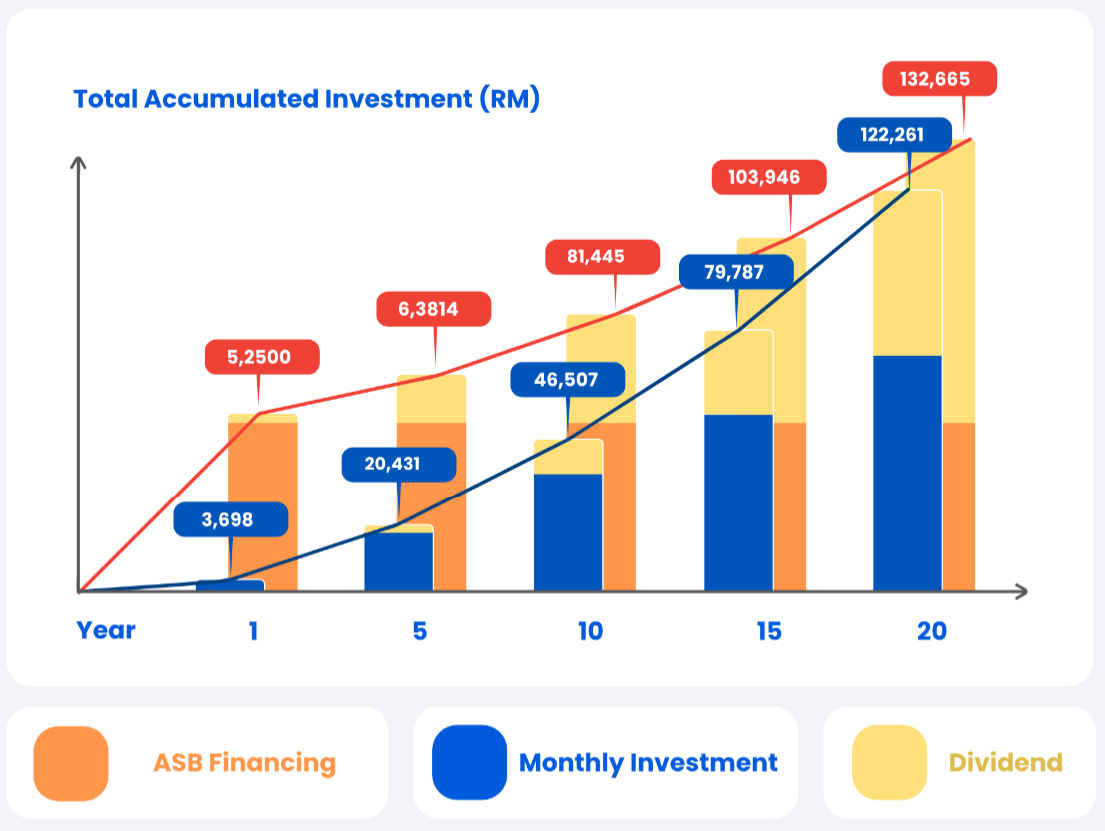

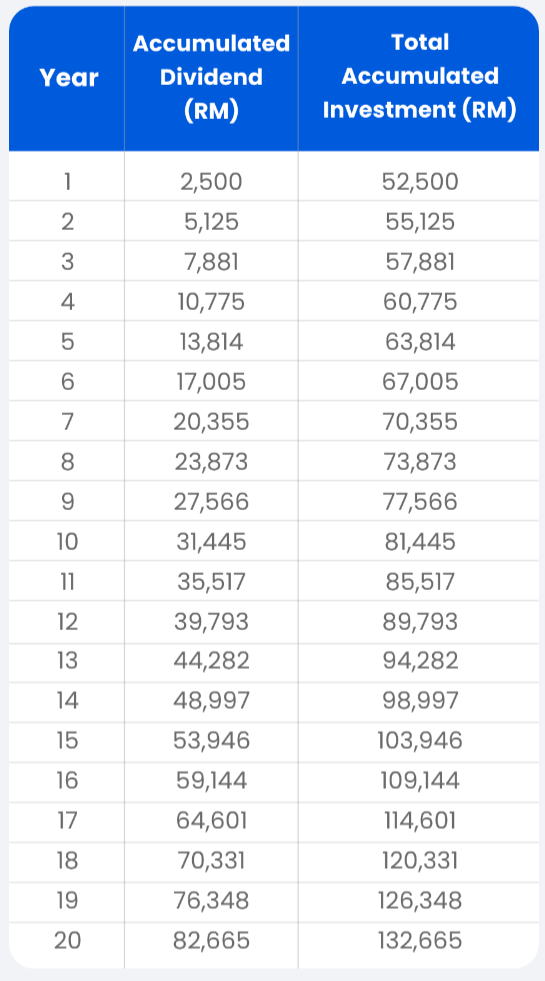

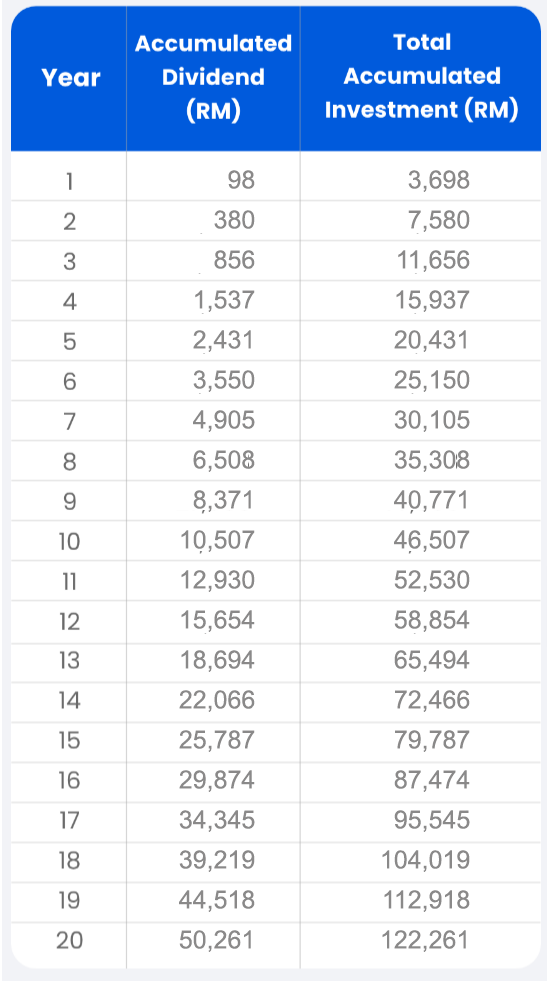

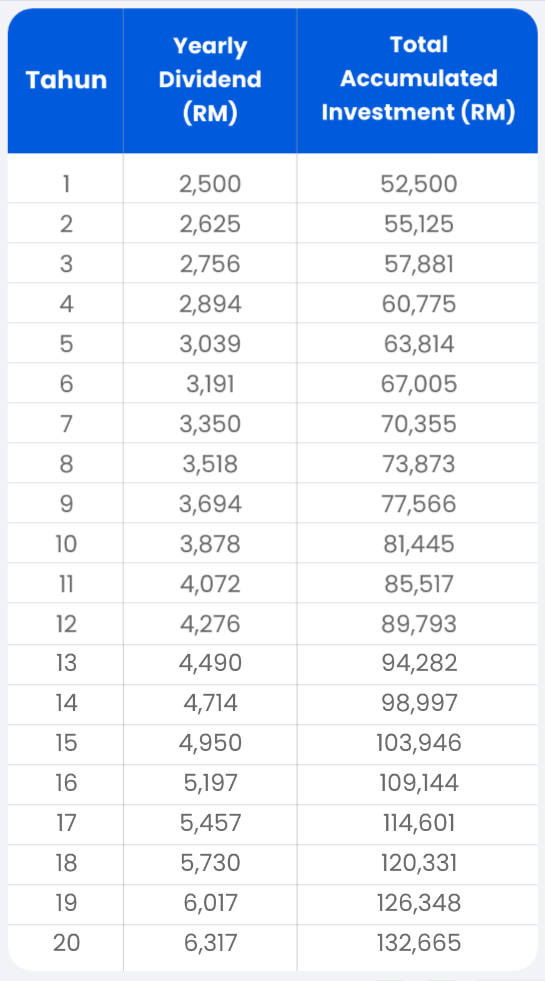

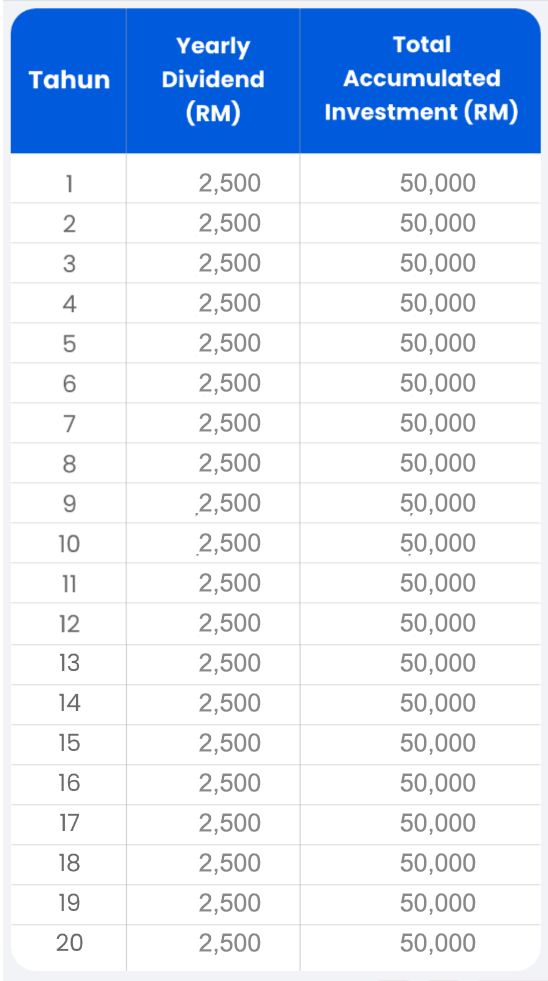

An opportunity to benefit from the compounding effect through lump sum investment and retained dividends compared with small amounts of monthly investments.

**based on ASB income distribution for financial year 2021

The past performance of a fund should not be taken as indicative of its future performance.

The past performance of a fund should not be taken as indicative of its future performance.

By retaining the initial investment and yearly dividend, it will generate a higher accumulated investment amount at the beginning the year and generate more dividend.

The past performance of a fund should not be taken as indicative of its future performance.

The past performance of a fund should not be taken as indicative of its future performance.

Where unit trust loan financing is available, investors are advised to read and understand the contents of the unit trust loan financing risk disclosure statement before deciding to borrow to purchase units. The disclosure statement will be provided by bank for ASB financing application.