Precious Inheritance To Your Loved Ones

Leave your inheritance to your loved ones.

Make it easier for them to claim after your demise.

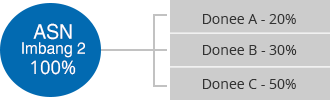

Hibah Amanah is the combination of "hibah" and trust concepts. It is a gift in the form of ASNB unit trust fund (Hibah Asset) from a Unit Holder (Donor) to his loved ones Donee(s) during his lifetime based on the terms and conditions stated in the Hibah Deed. Transfer of the asset to the Donee(s) takes effect only after the demise of the Donor.

Hibah Asset is the ASNB unit trust fund(s) registered under Hibah Amanah by the Donor during his lifetime through the Hibah Amanah Deed:

Under the Malaysian law, the trust is classified as personal property such as company shares. Thus, the inheritance of unit trusts is subject to the laws of probate and administration where only the administrator or executor appointed by the court can claim the deceased donor's assets. On the other hand, EPF and Tabung Haji were established under their own acts that allow direct nominees.

Without an alternative solution like Hibah Amanah, the estate distribution process is complicated and time-consuming. The situation will be more complicated if there are overlapping claims and disagreement among the beneficiaries.

Through Hibah Amanah, unit holders can plan their estate distribution to their beneficiaries and this will shorten the claim process after their demise.

Hibah Amanah is based on the Sharia law. However, Faraidh law still prevails in the estate distribution for Muslims. Therefore, unit holders are advised to be fair in distributing their Hibah assets.

A guardian must be appointed by the court who will be acting on behalf of the Donor based on the court's order.

Yes, but a guardian must be appointed to act on behalf of the minor Donee, age 18 and above or special need. The appointed guardian must be among:

Registration can be performed at any ASNB branch and selected/permitted agents (for first registration only).

Complete the following documents and submit with the registration fee:

Yes, the Ijab and Qabul are compulsory; therefore, both the Donor and Donee must agree to give and accept by signing the relevant documents.

Yes, subject to the minimum balance of 1,000 units throughout the period of Hibah Amanah.

Yes, subject to the minimum balance of 1,000 units throughout the period of Hibah Amanah.

The unit trust fund registered under Hibah Amanah can be suspended or frozen as ordered by the authority, subject to the terms and conditions of Hibah Amanah, Master Prospectus, Deed of the unit trust fund and the EPF.

One of the requirements for Hibah Amanah is to have an asset to be distributed. Therefore, the minimum balance of 1,000 units is necessary to ensure that there will be investment units available after the demise of the Donor as the Donor is allowed to do transactions during his life time.

No. Only ASNB unit trust funds can be registered under Hibah Amanah.

Yes. However, changes can only be made if it involves biological child and grandchildren. Otherwise, the revocation of the Hibah Amanah must be made and the Letter of Donee consent on return of asset to Donor must be submitted during application.

Administration Fee is charged annually for administration, data and document archiving for Hibah Amanah. This fee is waived for the first year of registration at the discretion of ASNB.

The annual administration fee is RM10.

From 01/12/2021 Administration Fee will be charged on the second year of registration as follows:

| No. | Scenario | Method for Administration Fee |

| 1. | Income distribution received from the fund selected for Administration Fee during registration is higher than the Administration Fee | Deduction from income distribution of ASNB fund selected for Administration Fee during registration; or |

| 2. | Income distribution received from the fund selected for Administration Fee during registration is lower than the Administration Fee | Deduction from principle units (excludes blocked units) of the selected fund for Administration Fee; or |

| 3. | Fund selected for Administration Fee during registration is not eligible for income distribution. | Deduction from principle units (excludes blocked units) of the selected fund for Administration Fee; or |

| 4. |

| Deduction from the 1,000 units blocked during Hibah Amanah registration. If the deduction was from the 1,000 blocked unit, the amount will be topped up from future income distribution (if any) |

No, this method will only be applicable for new registrations with effect from 01/12/2021.

No. The Donor may not change the unit trust fund previously selected for annual Administration Fee deduction.

In the event the Donor dies first, the Hibah asset will be the absolute right of the Donee(s). On the other hand, if the Donee(s) dies first, the ownership of the Hibah asset will be returned to the Donor. If the Hibah Donor & the Hibah Donee die simultaneously the Hibah Asset will be paid according to the current procedure of the estate.

Units invested via financing is subjected to the agreement between the Donor and the Financing provider. Units still under financing will be paid to the Financing provider. Only the Donor's wholly-owned units free from encumberance will be distributed to the Donee upon claim.

Based on Sharia law, Hibah Amanah cannot be revoked, except if it involves hibah to biological child or grandchild.